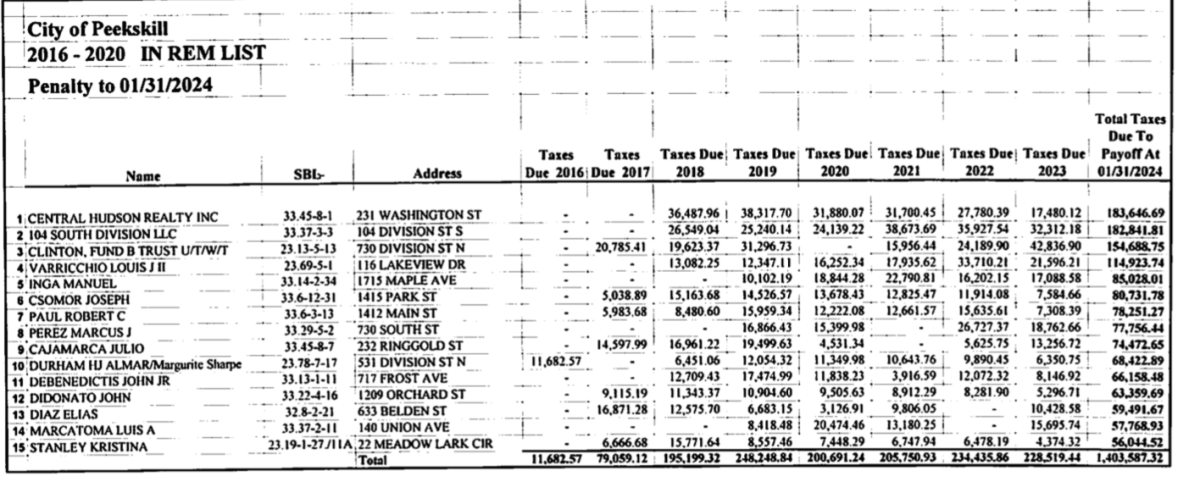

Records obtained by The Herald from the Peekskill Finance Department reveal that 15 property owners owe unpaid city, school and county property taxes totaling hundreds of thousands of dollars, with some of those bills dating as far back as 2016.

Like many other municipalities, Peekskill faces constant annual increases in expenses, from higher costs of healthcare for employees, rising insurance rates, and higher prices for supplies and materials.

Peekskill officials have warned that these projected budget shortfalls could require the city to override the state-mandated 2 percent property tax cap for years to come, increasing taxes annually by 3.5 percent instead, nearly doubling the rate of the allowed cap increase. The Common Council did raise the tax rate by 3.5 percent in the 2024 budget.

The Common Council is expected to raise parking meter fees and traffic fines on Monday, March 25 to raise additional dollars. Last year the fee schedule for selected permits and city transactions were increased.

But the city is failing to collect hundreds of thousands of dollars in revenue from property owners who just don’t pay the property taxes that everyone else hands over voluntarily every year.

Peekskill code calls for sale of tax liens, foreclosures

Collecting property taxes is a basic function of government. According to the City Manager’s 2024 budget plan, Peekskill does routinely pursue past-due property taxes. However, no auctions of tax debts have been held for five years.

In the 2024 budget, City Manager Matt Alexander wrote: “Tax Foreclosures: The City regularly pursues collection of unpaid taxes, through the in-rem foreclosure process by which the City can obtain title to tax-delinquent properties and auction them to new owners. Existing owners are always contacted and offered the option of paying off back taxes with an installment plan.

“Failing this remedy, the City has commenced an action to collect delinquent 2017 real estate taxes. This annual collection of past due taxes not only assures consistent cash flow, but also helps maintain the City’s positive financial profile with ratings agencies, resulting in lower interest rates on municipal debt.

“The Tentative Budget forecasts much less than the previously budgeted $600,000 in 2023 revenues from an in-rem auction. The last auction was in 2019. The Supreme Court ruling in Tyler v. Hennepin County which disallows municipalities from taking title, selling property, and keeping the proceeds, will significantly reduce this anticipated revenue. However, the City will continue to pursue its unpaid receivables for past due taxes and collect increased fines and penalties.”

[The Supreme Court ruled last May that a government agency can only keep the taxes owed if it sells a property and must give any excess funds back to the property owner.]

According to the Peekskill City Code, the comptroller can advertise for sale a tax lien on property for taxes 12 months past the due date or foreclose on tax debts and take possession of the property.

“Once in each year during the month of May or June, whenever any tax on lands or tenements or any assessments on lands or tenements for local improvements shall remain unpaid for the term of 12 months from the time the same shall have become liens on the real estate affected thereby, so as to be due and payable, and also whenever any water rents or other water charges in said City shall have been due and unpaid for the term of 12 months from the time the same shall have been due, the Comptroller may advertise the tax liens,” the city code reads.

Interest on past due property taxes builds rapidly at a rate of one and a half percent a month and by state law interest penalties cannot be waived. Because the interest charges compound, the total tax debt can double in less than four years, making it likely that the “death spiral” of debt will never be paid by the owner.

Peekskill does collect some past due tax revenue each year. In 2021 according to city records $168,883.87 was recorded as interest and penalties on real property. The 2024 projected figure is $275,000.

But the City of Peekskill is also harmed financially each year when school taxes aren’t paid. By law the city has to pay the school district whatever school taxes are due from its own funds and then collect those taxes to compensate for the money not received.

Failure to collect past due property taxes dates back years

Some of the outstanding bills of top 15 property owners with unpaid taxes date back to 2016, with most failing to pay their taxes every year since 2018.

Those 15 property owners owe the City of Peekskill a total of $1,403,587. according to records at the city’s Finance Department. The records seem to indicate that some have made partial payments over the years while skipping other years entirely. There is no indication that the city has initiated any procedures to collect these taxes owed.

The top five outstanding tax bills are: 231 Washington St., $183,646; 104 S. Division St., $182,841; 730 N. Division St., $154,688; 116 Lakeview Drive, $114,923; and 1715 Maple Ave., $85,028.

Here’s a look at five of the individual commercial properties and their owners. Phone calls for comment to each were not returned.

Known for years as Hatch’s Garage at the intersection of Washington Street and Hudson Avenue, the property was purchased by Central Hudson Realty Inc. in November 1999 for $250,000. According to land records in the county clerk’s office, Dartrey Thomas is the president of Central Hudson Realty. Unpaid taxes date back to 2018.

The owners of the Riley Building are suing Peekskill in federal court claiming they were denied a certificate of occupancy because of alleged religious bias. The property owners did finally receive the C of O in October 2023 despite then owing approximately $150,000 in back taxes. The principal behind 104 South Division LLC is Avrum Chaim Lebrecht.

The former Clinton Funeral Home property owes taxes dating back to 2017. The Peekskill building sits empty today while the Clinton family operates a funeral home in Cold Spring. According to land records the property was willed in 2015 to the Fund “B” Trust of James J. Clinton who died in 2006. The trustees are Rita Clinton, James Clinton Jr. and Christine Frasier.

The Stop-N-Go deli at the corner of South and Washington streets is owned by Marcus J. Perez of Croton, who purchased the property in 1984. Back taxes totaling $77,756 dating back to 2019 are owed to the city.

A listing on a website in 2020 advertised “… newly renovated three-bedroom apartments at 1412 Main St. and 1414 Main St. Peekskill, NY.” The property is owned by Robert Paul, and on his Bedford New York Real Estate website he writes that he is just out of the hospital in early March following a brain injury. Past due taxes date back to 2017.

Uncollected taxes could pay for personnel, city debt

Recovering the $1.4 million owed in back taxes from the city’s 15 largest delinquent property owners would help ease the budget pressure on city officials and could ease the burden of some higher new taxes on residents.

That money would cover nearly half of the Fire Department’s $3 million payroll or nearly 20 percent of the Police Department payroll.

The city projects adding $3.6 million in new debt in 2024, and could cut that amount by one-third. To cover its revenue shortfall Peekskill intends to take $2.1 million from its fund balance but would need only $700,000 if those back taxes were paid. Nearly half of the projected $2.7 million increase in retirement benefits could be paid.

The Supreme Court’s May 2023 ruling that property owners must be given any money recovered above the tax amount owed has caused some municipalities to search out legal opinions on how to proceed when taking action to collect past due taxes.

Requests for comment from Peekskill’s Legal Department and Comptroller’s office were not returned.